Who is at fault for a crash can be obvious. Similarly, figuring out what injuries have resulted from a crash seems like it should be simple.

However, no matter how clear things might be, there is no guarantee any insurance company is going to treat you fairly if you are involved in a crash. C.L and M.H. discovered this reality after a drunk driver hit them and caused injuries, tens of thousands in medical bills, and financial loss from time away from work.

At around 3:30 p.m. on April 30, 2021, our clients – C.L. and M.H. – were stopped at a red light facing south on southbound Mid-Rivers Mall Drive with their daughter, restrained in a car seat in the back of their Chrysler 300. They had just finished lunch at a Bar-B-Q restaurant and were headed home.

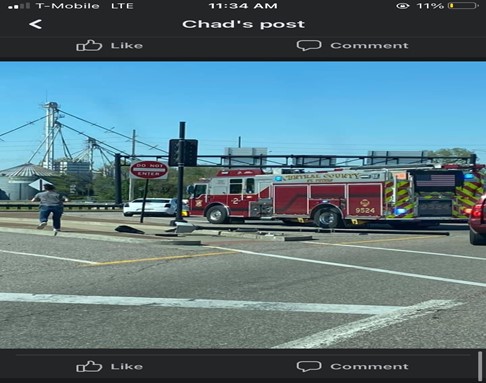

Mark Thiele was driving a GMC K3500 northbound on Mid-Rivers Mall Drive at the IS-70 overpass in St. Charles County, Missouri. He crossed several lanes into southbound Mid-Rivers Mall Drive, struck a curb, and ran over an electrical crosswalk signal.

After knocking the pole down, Mr. Thiele accelerated northbound into southbound traffic and hit our clients’ vehicle and one other.

Mr. Thiele fled the scene and was eventually captured and arrested. He was visibly intoxicated by the time he was found. He was charged with DWI and fleeing the scene.

M.H. sustained a comminuted (i.e., meaning reduced to multiple particles) tibia fracture, a fibula fracture, and an ankle fracture. She underwent emergency Open Reduction Internal Fixation surgery that day. C.L. sustained a shoulder injury and was eventually diagnosed with a labral tear in the shoulder that required surgery.

The Insurance Companies Responses

Mr. Thiele was insured by State Farm. Once the victims hired us, one of our first steps was to contact State Farm and request a copy of Mr. Thiele’s insurance policy. In response, State Farm provided a policy showing a $250,000 per person/$500,000 per occurrence limit. This would mean that Mr. Thiele was covered for up to $500,000 that could be divided amongst all claimants and that no claimant could receive more than $250,000. We requested more insurance information from State Farm. Although they had initially provided a $250,000/$500,000 policy, further investigation revealed there was an extra “umbrella” policy that added $1 million in coverage to the case.

We contacted our clients’ insurance carriers to set up claims for medical payments coverage and for underinsured motorist coverage. One of the underinsured carriers initially denied the claim, blaming our clients for the crash (despite the fact they were stopped at a red light). We pushed back and pointed out what would seem to be obvious to any reasonable person, and the insurer agreed, reversing its liability decision.

At this point, with liability being agreed to and coverage being disclosed, we attempted to negotiate a settlement. During settlement discussions, Mr. Thiele passed away for reasons unrelated to the crash, leading to failed negotiations.

The Lawsuit

We filed suit against a Defendant Ad Litem, which is someone appointed by the court to stand in the shoes of the person at fault for the crash. We litigated the case for about two years, requiring us to spend time and money on about a dozen depositions, to respond to numerous motions to dismiss various claims and subtle attempts to delay trial.

We did not receive a settlement offer until the week before trial. We settled the claims of C.L. for $150,000. However, the offer to M.H. was only $300,000, which was about half of what we believed the case was worth. Despite making a counter-offer to settle for $700,000, State Farm insisted on sticking to $300,000.

The Trial

The case proceeded to trial. State Farm admitted fault but not that Mr. Thiele was intoxicated. It also admitted M.H. had suffered a broken leg but disputed the extent of her injuries. State Farm wanted to talk about the fact the amount needed to satisfy M.H.’s medical bills was only about $20,000. Insurance companies love to talk about medical bills, particularly in conservative venues like St. Charles County because they think jurors will feel like they are giving the plaintiff a great deal by forcing the defense to pay for medical bills. The reality, however, is that a judgment for $50,000-$75,000 (which is what State Farm told the jury to award) would not have put much of any money in M.H.’s pocket at all, particularly after all she was put through with the lawsuit.

Knowing these numbers did not in any way reflect the extent of M.H.’s injuries, we withdrew the claim for medical bills and successfully moved to exclude any reference to them. That, however, did not stop the defense. State Farm went so far as to hire an “independent” medical doctor to review all of M.H.’s records and offer an “expert” opinion about the extent of her injuries. The spine surgeon expert testified M.H.’s leg was basically back to normal, despite the fact it has a metal rod in the bone and despite her complaints of ongoing pain.

The jury disregarded the “expert” testimony and awarded M.H. $750,000. The court assessed taxable court costs and interest as well. There was no basis for appeal, and the judgment was paid shortly thereafter.

In addition to the more than $900,000 recovered from State Farm, Kevin Etzkorn Law was also able to recover the limits of our clients’ medical payments coverage.

Hurt in an Accident? Call Kevin Etzkorn Law

Whenever you are in a car accident, you should contact a lawyer. You ultimately may not need to hire one, but you should at least get a free consultation before you try to resolve the claim on your own. The unfortunate reality is that most insurance companies aren’t going to make a reasonable settlement offer unless you have a lawyer. And even if you have a lawyer, litigation or even a trial might be the only way to get fair compensation.

While C.L. and M.H. were fortunate, many other car accident victims aren’t so lucky. Insurance companies look for ways to deny, delay, or reduce a claim. Another victim of this same crash decided to negotiate on his own and accepted a $17,000 settlement very early on. We do not know much about his injuries, but we wonder whether he knew about the umbrella insurance when he settled his case. We’re fairly certain the insurance company doubted the extent of his injuries and offered less than what they knew they would have to offer if he was represented.

We understand that calling an attorney can be scary. We acknowledge that most people don’t want to sue if they don’t have to. However, it’s crucial to safeguard your legal rights, and no insurance company will take on the responsibility for you.

If you or someone you love has been in a car accident, call Kevin Etzkorn Law at (314) 987-0009 today for a free case review.

The content provided here is for informational purposes only and should not be construed as legal advice on any subject.